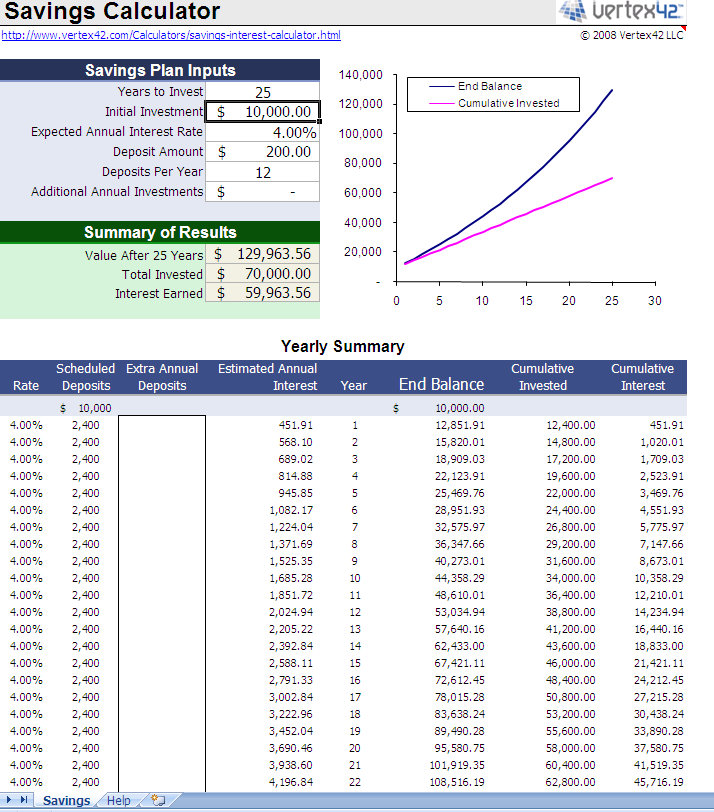

There is a chance that you may outlive your savings.Your present retirement funds may not last throughout your retirement.If inflation grows faster than your retirement savings, it could mean that: If the inflation rate increases to 4%, the cost of living would double every 18 years.If the inflation rate is at 3%, the cost of living would double every 24 years.

Consider how inflation affects your cost of living: That's the power of compounding and having time work for you.Īll of us have to cope with the impact of inflation. Assume that their investments both grow at 4% a year:ĭespite saving less per month and less in total, Andy ended up with a significantly greater amount of savings than Bob because he started out earlier. Just how much of a difference does it make to start early?ĮxampleAndy started saving $250 a month 30 years ago while Bob started saving $400 a month 20 years ago. Ĭonversely, the longer you wait, the less time you have for your money to grow and the harder you'll have to work to reach your retirement goals. Starting earlier means more time for your savings to benefit from the effects of compounding returns. While it is never too late to start saving and planning for retirement, the earlier you start, the better. With inflation, will the retirement funds I have amassed be enough for the lifestyle I want?.Many people are uncertain of achieving a comfortable retirement, because of these common doubts:

RETIREMENT SAVINGS PLANNER HOW TO

Those who do, however, may be saving too little, or know too little about how to go about accumulating and preserving their wealth. Some point to their CPF savings to provide for their retirement needs. Those who do not act early on planning for retirement say it requires too much discipline and sacrifice. But this mindset hinders the goal of being able to retire.

0 kommentar(er)

0 kommentar(er)